Create feature-rich windows applications with many new components and universal dialogs.

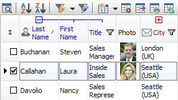

- improved DBGrid

- new DBRecordView, DBTreeView

- toolbars and db dialogs to Find, Filter, Sort, Export, Print...

- StringGrid with columns definition

- GroupBox with automatic alignment and resizing of owned controls

And many more from $25 to $95 only - click for details!

| A B C D E F G H I J K L M N O P Q R S T U V W X Y Z Other |